What are the differences in functionality between Tally ERP 9 Full Version (paid) and its free version?

Popular accounting program Tally ERP 9 is utilized by companies of all kinds, from little startups to enormous conglomerates. To assist in managing financial transactions, inventory, payroll, and other tasks, it provides a wide range of features and capabilities. Tally ERP 9 is available in two forms, the complete version (which costs money) and the free version. The functional distinctions between these two versions are frequently unclear to many users. To assist you decide which one could work best for your company's needs, we will examine and clarify the differences between Tally ERP 9 Full Version (paid) and its free version in this post.

-

Licensing and Validity

Licensing is a legal framework that authorizes a person or entity to make utilization of particular intellectual property, for instance, software, trademarks, and patents. It grants the licensee the privilege to employ the sanctioned material in return for payment of a licensing fee. The timeframe of validity of a license is ascertained by the regulations presented in the licensing agreement. The most accepted classifications are perpetual and restricted period. A perpetual license offers an indefinite authorization to make use of the sanctioned material, while a limited-term provision specifies an expiration date after which the user must discontinue using it. Certain licenses even feature renewal alternatives where users can broaden their expiry period by remitting additional fees. It is indispensable for both parties involved in a licensing agreement to plainly determine and grasp the terms of validity. This comprises factors such as geographic limitations, extent of usage, and any limitations on revisions or redistribution. Disregarding these stipulations could result in termination or annulment of the license. A careful analysis and adherence to licensing agreements' validity clauses are basic for ensuring just utilization rights between licensors and licensees. -

Core Accounting Features

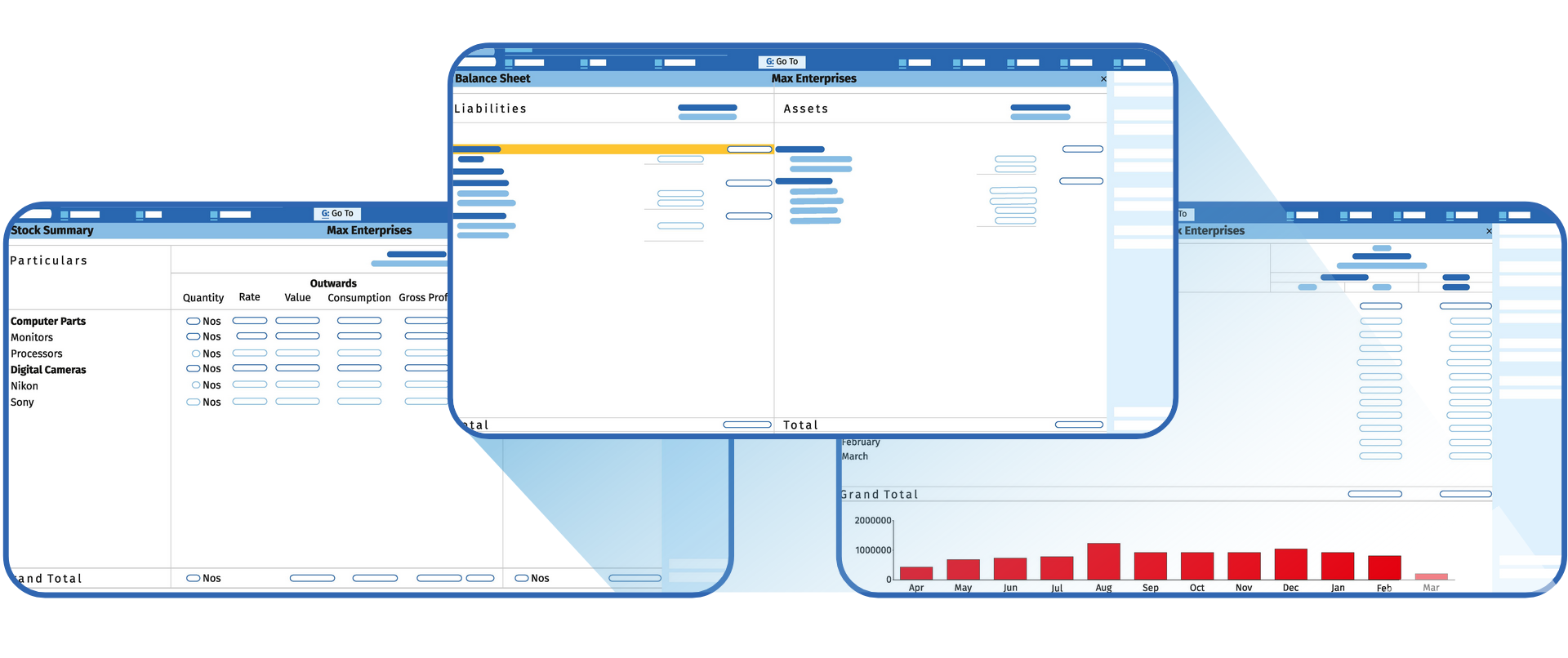

The management of financial transactions and guaranteeing the correctness of a company's financial records require the use of core accounting functions. General ledger, accounts payable and receivable, billing and invoicing, inventory management, payroll processing, and financial reporting are some of these functions. All financial transactions are centralized and chronologically documented in the general ledger. By displaying a company's assets, liabilities, equity, revenue, and spending, it gives a general idea of its financial health. Businesses can monitor money owing to suppliers or consumers using accounts payable and receivable, respectively. Billing and invoicing enable businesses to create invoices for the products or services they supply to clients while also keeping track of payments made. Inventory management ensures that businesses have accurate records of their stock levels to avoid shortages or overstocking. Payroll processing simplifies employee salary calculations while adhering to tax laws. Financial reporting provides insights into a company’s profitability through profit & loss statements or balance sheets. Core accounting features play a crucial role in helping businesses maintain accurate records of their finances while streamlining various processes related to sales, purchases, payroll management, etc., allowing them to decide on their future growth initiatives with knowledge. -

Inventory Management

Inventory administration is an absolutely essential aspect of business operations that requires competent and effective handling, monitoring, and conservation of goods in storage. It serves an essential function in refining supply chain activities, mitigating expenditure, and addressing customer requirements. A major element of inventory management is precise forecasting to decide the ideal amount of inventory essential at any given time. This necessitates the investigation of past information, current market tendencies, and demand patterns to accurately project forthcoming needs. Another substantial facet is inventory control, which assures that items are available when required while limiting superfluous or antiquated stock, bearing in mind systems such as just-in-time (JIT) or lean manufacturing approaches to retain inventory levels low while still providing product accessibility. Correct tracking strategies must be in place to chart inventory motion from receiving to storage to delivery. This allows organizations to determine potential problems such as pilferage or spoilage promptly and take restorative action. -

Payroll Management

Payroll organization is the act of dealing with and sorting out staff repayment, including compensations, wages, rewards, withholdings, and charges. It is fundamental for verifying that laborers are paid precisely and on schedule while adhering to legitimate guidelines. The payroll office is in charge of keeping precise records of representative participation, hours worked, wiped out leave, and occasion pay. They additionally figure extra time pay and guarantee suitable imposition withholding dependent on government and state laws. An effective payroll administration framework not just guarantees timely installment to representatives yet in addition helps with budgeting and anticipating work costs for the foundation. With the headway of innovation, numerous associations are currently utilizing mechanized payroll frameworks that optimize forms, for example, information section, counts, expense recording, and coordinate store installments. Be that as it may, dealing with payroll can be mind-boggling as it includes managing delicate data, for example, government managed retirement numbers and budgetary data. Hence, firm safety efforts must be set up to secure this data from any potential breaks or digital dangers. -

GST and Taxation Modules

GST (Goods and Services Tax) is an extensive indirect taxation system acting on the provision of products and services in India. This dispenses with the demands of miscellaneous burdens, such as excise obligation, service tax, VAT, etc., guaranteeing a more organized and proficient administrative system. The imposition of GST has elicited sweeping transformations to the Indian economic system by easing tax restrictions between states, abetting ease in commerce, and enhancing obedience. GST envelops three subdivisions of taxes- CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), and IGST (Integrated Goods and Services Tax). Both the central and regional governments collect these levies as per their particular rulings. Moreover, the governments constantly broadcast current updates on division in toll rates or particular codes. There are hefty specialised tax modules intended to serve particular sectors, for instance fabrication or services. These systems provide customised features attuned to the unique stipulations of each market. -

Data Security and Backup

Data security and making backups are extremely important for any organization that relies on digital information. In the event of a data breach, cyber-attack or natural calamity, these measures help protect valuable data from loss or compromise. Encrypting sensitive data is a reliable technique to ensure security as only those with the correct decryption key can access it. In addition to this, firewalls and strong password policies can provide an increased level of safeguard. Having a dependable backup system is also paramount and this supports backing up pivotal data to an external venue or cloud storage service. This ensures that vital data remains available even when the major repository is breached. To remain up-to-date with advancing threats and technology enhancements, frequent tests and updates of security systems are imperative. -

Multi-user and Remote Access

Multi-user and remote access offers the ability for multiple individuals to connect to a given system or network from varying locations. This functionality offers a course of increased efficiency in teamwork, as people can cooperate on certain endeavours without the need for being in close proximity. For such to take place, a principal server should be present to direct each user's connection. The key advantage to multi-user and remote access is improved output. With it, teams are able to juggle multiple endeavors rapidly, producing desired effects in a short window of time. It also permits people limited periods of opportunity to be able to work from remote locations without foregoing availability for their role within the team. Conversely, there are potential security concerns that must be addressed. It is of paramount importance to ensure that only authorised accesses are provided while securing sensitive data through appropriate encryption methods. Failure to do so might open up chances of the information being accessed in an unauthorised way. -

Customer Support and Updates

Excellent customer service and regular updates are foundational components of any flourishing business. In today's expeditious world, clients anticipate prompt and proficient assistance whenever they have a doubt or unease related to a product or service. Therefore, companies must install expeditious customer support structures. One way of certifying prompt customer service is having a dedicated group available round the clock to answer to queries. This team should be well-prepared and have a good grasp of the organization's products or services to guarantee accurate information and solutions. Aside from giving immediate help, customary upgrades on products or services are vital for retaining high-quality client relations. Customers welcome being kept abreast of progress, enhancements, and novel characteristics of the commodities or services they utilize.

Conclusion

To summarize, the main distinctions between Tally ERP 9 Full Version and its free iteration are seen in the additional functions and functionalities offered by the purchased version. Whereas both versions include basic accounting and inventory control applications, the comprehensive version comprises additional modules such as budgeting, payroll execution, and compliance with taxation codes. Choosing between the Full and free versions of Tally ERP 9 hinges on what a company requires from their financial management solution. The Full version offers limitless company formation and user creation while the free one imparts restrictions in those areas. Selecting the right option for a business means deciding which of these characteristics is most important. If unrestricted company development and user quantity are called for, then opting for the Full Version is the advisable path.